Get the free global blue tax form pdf

Show details

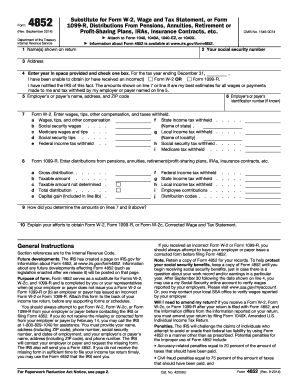

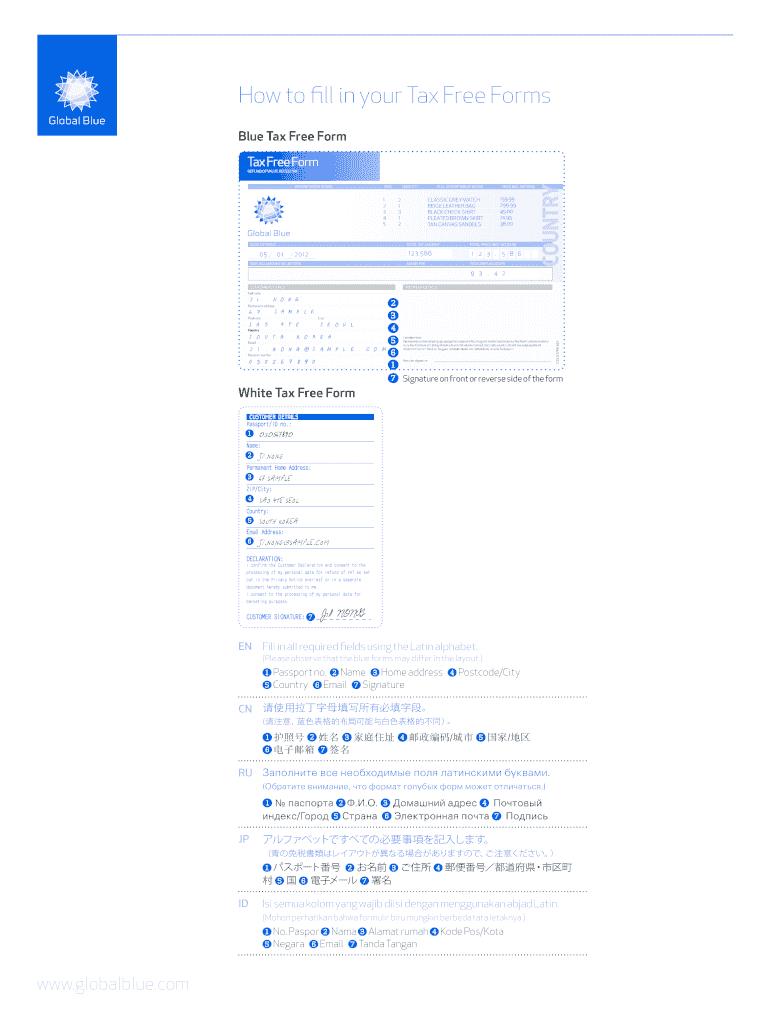

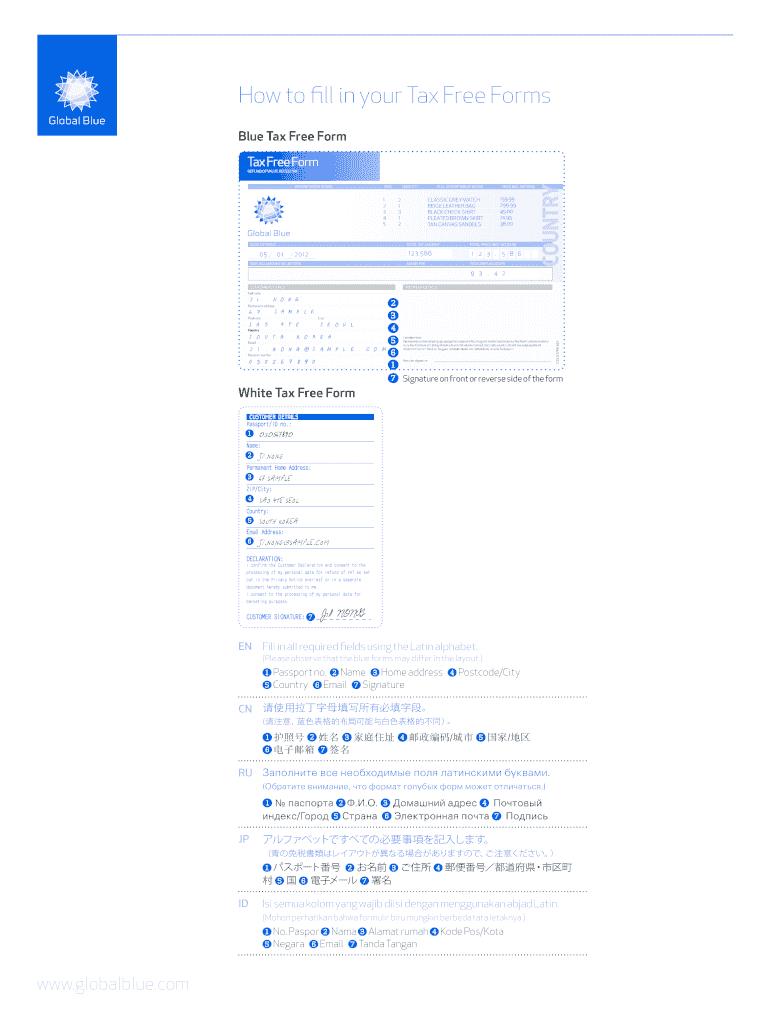

How to fill in your Tax Free Forms Blue Tax Free Form 2 3 4 5 6 1 7 Signature on front or reverse side of the form White Tax Free Form 1 2 3 4 5 6 7 EN Fill in all required fields using the Latin

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign global blue tax form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how do i get global request a tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing global blue tax formular pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax form global blue. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out global blue tax form pdf download

How to fill out global blue tax form:

01

Begin by gathering all necessary information such as your personal details, passport information, proof of residency, and receipts for your purchases.

02

Carefully read the instructions provided on the form to ensure you understand the requirements and specific information that needs to be provided.

03

Start filling out the form by entering your personal details accurately, including your full name, address, and contact information.

04

Proceed to provide your passport information, ensuring the details match exactly as stated in your passport.

05

Fill in the required sections regarding your residency status and any applicable residency permits.

06

Move on to the section where you need to list the details of your purchases. Include the name of the store, the date of purchase, the description of the item(s), and the amount spent.

07

Attach all relevant receipts to support your purchases, making sure they match the details provided on the form.

08

Double-check all the information you have entered to ensure accuracy and completeness.

09

Sign and date the form as required.

10

Submit the completed form and all supporting documents to the designated authority, following the instructions provided.

Who needs global blue tax form:

01

Travelers who are non-residents of the country where the purchase was made may need a global blue tax form.

02

Individuals who have made eligible purchases and wish to claim tax refunds on those purchases.

03

Tourists and international shoppers who meet the criteria set by the local tax authorities for tax-free shopping.

Fill

tax form

: Try Risk Free

People Also Ask about how do i get global blue tax form request a tax form

Does Global Blue charge a fee for tax refund?

The debit fee will be 5% of the full VAT amount or 15% of the refund amount, as applicable.

Can I do Global Blue online?

Issue your Tax Free Form directly on your mobile phone in few steps. Manage your Tax Free purchase wherever, Whenever on your mobile.

How much is global blue tax refund?

Extra-ordinary Shopping Deals From October 2022 look forward to an extra 20% refund when shopping exclusively with us until March 2023.

How do I get global blue Tax Free form?

In-store the sales staff needs to scan your passport and the sales receipt. At least 24 hours before your departure, scan the QR code on the leaflet or click on the link received via email with your phone to request a Tax Free Form.

Can you get VAT refund without form?

Without the stamp, you will not obtain the refund. You must then follow the steps explained at your refund document or by the shop assistant. You can claim your VAT refund in bigger airports immediately, otherwise you will have to send the refund form to the address given in the shop.

How long do global blue refund take?

If you don't receive the refund within 10 working days, please contact our Customer Service to check the status. If your form is electronically validated, the refund will be automatically paid to your refund method within 10 days.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit the purpose of the global goods and the merchant's information from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your global blue tax form download into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit global blue tax formular download straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing global blue form right away.

How do I fill out detax export catalogue 2023 detax on an Android device?

Complete your global blue tax refund and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is global blue tax form?

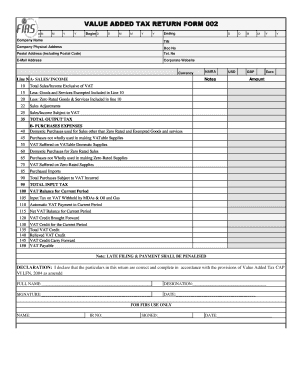

The Global Blue tax form is a document used by travelers to claim VAT (Value Added Tax) refunds on eligible purchases made in certain countries when they export these goods outside the EU.

Who is required to file global blue tax form?

Travelers who reside outside the European Union and have made qualifying purchases in EU countries are required to file the Global Blue tax form to obtain VAT refunds.

How to fill out global blue tax form?

To fill out the Global Blue tax form, a traveler must provide details such as their personal information, the date of purchase, the amount spent, and information about the purchased goods. The form is usually provided at the time of purchase or can be filled out at the airport when claiming a refund.

What is the purpose of global blue tax form?

The purpose of the Global Blue tax form is to facilitate the VAT refund process for non-EU residents, allowing them to reclaim the tax paid on eligible purchases when they leave the EU.

What information must be reported on global blue tax form?

The information that must be reported includes the traveler's name, address, passport number, date of purchase, total amount paid, details of the purchased goods, and the merchant's information.

Fill out your global blue tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Formular Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to global blue tax form example

Related to tax formular

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.